Lately, we have been taking you through a series on how to maximize your portfolio value in our Closed Beta program. And this is the fourth installment.

If you are just joining us, here are a few things you need to know;

- Every participant will receive $25,000 worth of virtual crypto assets.

- Among the asset class, participants will receive 4 tokens to their accounts — ETH, DOT, USDT, USDC — which they can use at their discretion.

- The top individual and team performances will share in the $40,000 bounty worth of EQ tokens.

- To win prizes, users have to maximize profits and increase their portfolio values by the end of the beta phase.

To make a profit, you can choose to do either of the following things; lend your assets and earn interest from borrowers, protect system solvency by automatically selling insurance to borrowers and earn high-interest rewards, or go bullish or bearish on a prospective token on the Equilibrium DEX.

How to Go Bullish or Bearish and Earn on Your Investment

There’s one somewhat rational approach (the laziest approach), which is to wait out without doing anything, hoping that your DOT and ETH in your portfolio will appreciate in value. But if you have a bullish outlook on the market, you can accept more risk and amplify your profits.

For this purpose, you can buy Bitcoin (or any other asset supported on Equilibrium DEX) and earn on its price appreciation with our up to 5X leverage. However, if the Bitcoin price falls, you will lose your funds.

Conversely, if the market looks bearish, you may sell BTC, ETH, and DOT and possibly short sell BTC, ETH, or DOT, or some other asset with leverage to maximize possible gain and your portfolio value. However, if the asset you sold rises, you will also lose your funds.

How Much Will this Help with The Portfolio Growth?

Let’s consider a short selling example:

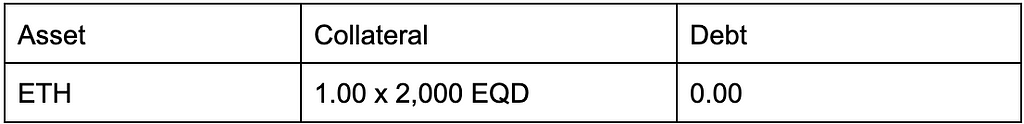

- Borrower deposits 1 ETH as collateral @ 2000 EQD price

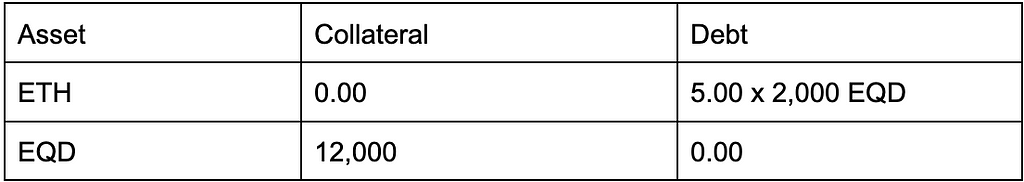

2. Borrower short sells 6 ETH @ 2000 EQD and ends up with the following portfolio:

Notice the 5 ETH debt which came from selling 1 ETH borrower owned and another 5 on margin.

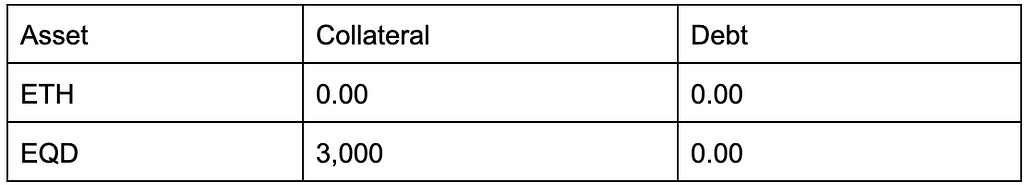

Now let’s say ETH dropped to 1,800 EQD in price, borrower can then buy back 5 ETH @ 1800 EQD and end up with net profit of 3K EQD:

Effectively, the borrower increased his initial portfolio value by 50%: he came in with 1 ETH @ 2000 EQD and ended up with 3K EQD stablecoin after covering his short position.

Conclusion

Our Closed Beta launch is a golden opportunity to explore Equilibrium’s core functionalities (and win fantastic prizes) before we go live. We have restricted this phase to only 500 participants and spots are filling up real fast as registration ends on 10th September, 2022. So hurry!

About Equilibrium

Equilibrium is a one-stop DeFi platform on Polkadot that allows for high leverage in trading and borrowing digital assets. It combines a full-fledged money market with an orderbook-based DEX. EQ is the native utility token that is used for communal governance of Equilibrium. xDOT is a liquid and tradeable wrapped DOT that unlocks liquidity of DOT locked in parachain auctions and delivers multiple crowdloan bonuses on Polkadot.

Join Equilibrium on Discord, News Channel, Twitter, Medium, Website, GitHub

How To Maximize Portfolio In Closed Beta. Case 4: Leveraged Long & Short was originally published in Equilibrium on Medium, where people are continuing the conversation by highlighting and responding to this story.