This is the second part of our Closed Beta lesson series. If you haven’t registered yet, you can still apply using this form.

And if you missed the first part, you can learn more about how to lend and earn interest rates in our Closed Beta.

In this lesson, we’ll be discussing how you can insure the system (take the risk of borrower liquidations) and earn an interest rate in EQ tokens.

NOTE: All assets in Closed Beta are virtual and your operations are not implying risks of losing money or real profits.

About Insurers

One of the biggest problems in decentralized finance is capital inefficiency. And Equilibrium has devised several means to increase capital efficiency. One of them is through the addition of insurers — also called bailsmen — to the system.

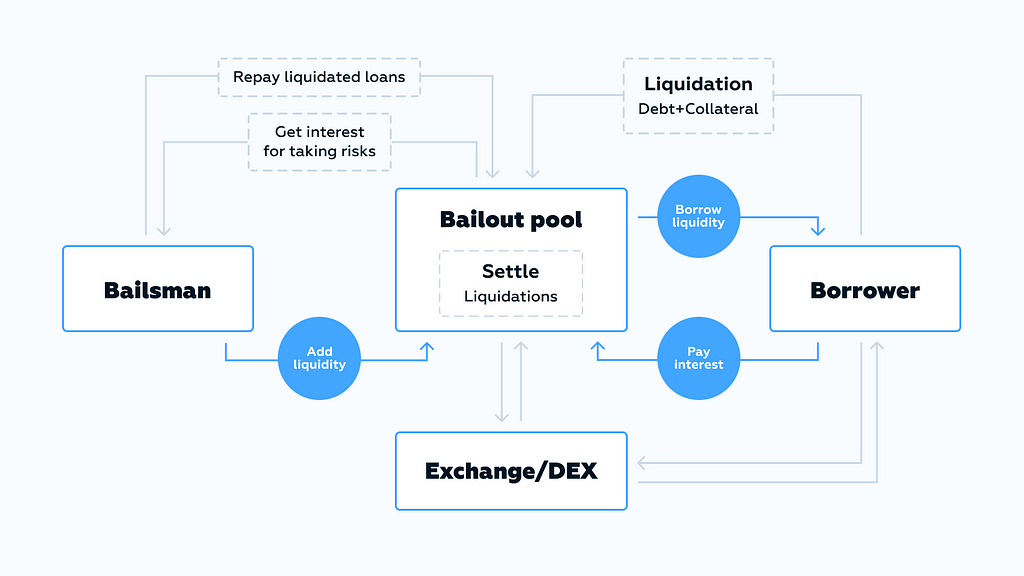

Insurers provide liquidity like lenders. The difference between lenders and insurers is that lenders provide liquidity to the liquidity pool so borrowers can access funds while insurers provide liquidity (in the form of upfront bailouts) that is used to recapitalize defaulted loans in the event of critical margin calls. This cushion helps the system stay solvent and allows for lowering collateral requirements.

How to Be A Bailsman and Earn Interest on Equilibrium

Every participant will be given a portfolio worth $25,000 worth of virtual assets.

The supported crypto-assets are BTC, ETH, DOT, USDT, USDC, BNB, ACA, GLMR, ASTR, INTR tokens. But users will get a limited number of assets — DOT, ETH, USDT, USDC — for a better user experience and not feel overwhelmed with a huge portfolio of assets.

As a bailsman, you will deposit funds in the insurance pool. Bailsmen can make money through two means. First, borrowers will pay you variable interest based on their risk profiles. The riskier their positions are the more interest you get on taking liquidation risks.

Second, should borrower positions get liquidated to the critical margin call level, bailsmen funds can be used to secure the pool. For this, you will get a portion of both the borrower’s collateral and the 5% borrower liquidation penalty.

How Much Will this Help with The Portfolio Growth?

To assess how much you can earn as a bailsman, let’s assume that, on average, the system is at 200% collateralization level and an average risk of 5% a day (average portfolio volatility across the system). Bailsmen can expect to earn around 6% APR on their funds in EQ tokens. For more details on how Equilibrium calculates interest rates you may refer to Equilibrium documentation. This is a reward on top of the 5% penalty bailsmen receive from the liquidations.

To lock in your gains as an insurer, you must manage the debts and collaterals you earn in a timely manner by trading them off on the Equilibrium DEX or bridging in assets to cover those debts. Also, you may cover debts in other exchanges in the Polkadot ecosystem.

Conclusion

Our Closed Beta launch is a golden opportunity to explore Equilibrium’s core functionalities before we go live. Spots for the Beta are filling up real fast and registration ends on 10th September. So hurry!

About Equilibrium

Equilibrium is a one-stop DeFi platform on Polkadot that allows for high leverage in trading and borrowing digital assets. It combines a full-fledged money market with an orderbook-based DEX. EQ is the native utility token that is used for communal governance of Equilibrium. xDOT is a liquid and tradeable wrapped DOT that unlocks liquidity of DOT locked in parachain auctions and delivers multiple crowdloan bonuses on Polkadot.

Join Equilibrium on Discord, News Channel, Twitter, Medium, Website, GitHub

How To Maximize Portfolio In Closed Beta. Case 2: Insurance was originally published in Equilibrium on Medium, where people are continuing the conversation by highlighting and responding to this story.