In-depth analysis of KONOMI collateral and liquidation model

1. Introduction

The year 2020 is definitely a memorable year in the chronicles for the financial industry as the global economy experienced the most unprecedented challenges and faced the greatest crisis ever since World War II. Traditional financial sectors such as the US securities market have experienced tremendous unstability due to COVID-19, the quantitative monetary easing policy of the US government as well as the US government elections. As a result, A large number of SMEs faced business setbacks as they were unable to obtain loans from traditional financial enterprises due to various reasons like the erosion of collateral values. Such phenomenon has triggered the concern of investors and entrepreneurs about the future viability of traditional financial models in the modern world context. To better adapt to the ever-evolving world, Konomi developed its own lending platform through the Polkadot ecosystem to tackle the existing problems and flaws of traditional money lending platforms. Polkadot is a platform based on Substrate, which is more flexible for transactions within the shared security umbrella and has a comparatively lower entry requirement for general users. For the blockchain industry and traditional financial intermediary platforms, Polkadot is not only a gate-crasher, but also a complete game-changer.

In the near future, Polkadot Ecosystem will establish a complete decentralised Web 3.0, providing all users with absolute autonomy and control. In other words, each user will be free from the influence of all central authority and will have full control of their identity and data management. The Polkadot Ecosystem aims to enhance userbility and user experience by connecting private chains, alliance chains, public chains, open networks and oracle machines, as well as future technologies yet to be realised. In doing so, independent blockchains will also be able to exchange information and conduct transactions through the Polkadot Ecosystem.

The complex logic and powerful engineering capabilities supporting Polkadot Ecosystem brought unprecedented development to the blockchain ecosystem and provided new perspectives for investors to explore. Compared to the rapid development of DeFi on Ethereum, Polkadot’s DeFi ecosystem is still at an initial stage with unlimited potential to be delved into. Konomi, as a decentralised lending project, perceive the security of all users’ assets as the top priority. In order to make sure that all users are well-protected, Konomi innovatively adopts the method of combining mathematical modelling and empirical evidence of economic theories, adding reconciliation variables supported by empirical data to the mathematical model, becoming the pioneer in the industry to integrate theory and empirical evidence. Further, it also provides a new resolution in dealing with “black swan” events which can be prominent in the blockchain industry.

2. Introduction to the KONOMI Collateral and Liquidation Model:

The Konomi liquidation model has undergone rigorous mathematical derivation and empirical testing of historical data. The team has conducted an empirical analysis of economics using years of high frequency historical data from the three major Exchanges, namely Binance, Huobi and OKEX. Taking into consideration the periodicity of cryptocurrency prices and “Black Swan” events, we have reached a conclusion that proves to be in line with the team’s initial expectations. With strong research ability and constant testing, we can safely say that the model is able to protect the legitimate rights of traders in both lending and borrowing even under extreme circumstances.

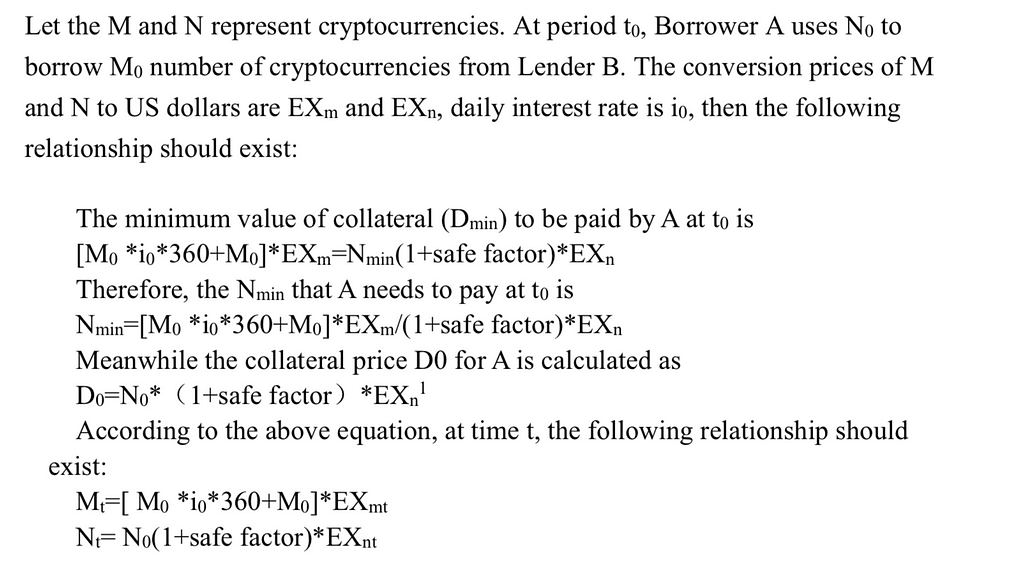

2.1 Introduction to the collateral model

2.2 Introduction to the Liquidation Model

Based on empirical simulations and with reference to findings from other projects, our team believes that the relationship that triggers liquidation on this platform is:

3. Factor Identification in the Collateral and Liquidation model

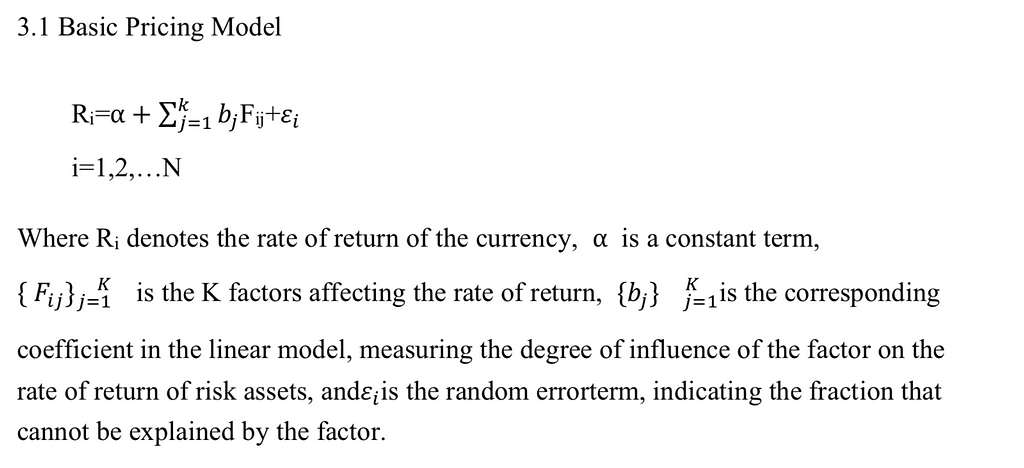

Taking the theories of Traditional Finance’s Mean-Variance Criterion, Arbitrage Pricing Theory and Multifactor Model as the fundament, taking into consideration cryptocurrencies’ high volatility at this stage, high tail risk and a large differential gap in trading volume between currencies, the team proposes an innovative model to determine the various factors in the collateral and liquidation model on this platform.

3.1 Introduction of Factor Selection Methods

In traditional finance markets, selection of factors includes fundamental-related factors (valuation, cash flow, profitability etc.) and technical factors (momentum index, CYE etc.). However, the non-disclosure nature of cryptocurrencies and its high volatility resulted in a lack of fundamental-related information or large deviations. Therefore, this model uses technical factors in the early stage of setting up, classifying them into 8 types of factors including BRAR Index, Variable Distribution Index, Directional Movement Index, Volume Index, Inverse Directional Movement Index, Relative Strength Index etc.

When further examined,

- Directional Movement Index include ACD, BBI, BIAS etc;

- Inverse Directional Movement Index include CCI, KDJ etc.;

- BRAR Index include ARBR, CR, VR, etc.;

- Volume Index include: PSY, VOSC, VSTD, etc.

3.2 Brief Description of The Empirical Methodology

The team has conducted a rigorous empirical analysis based on the above-mentioned basic pricing model to determine specific factors to be used for each currency and their respective weightage.

Data used for this model is high frequency trading data (0.5 millisecond daily) of each currency over the last three years (if the currency has yet existed for three years, the date chosen is the first day of trading to 10 January 2021). The methods to be used include OLS, 2OLS, Mixed Estimation Models, and Knowledge Graph to build a quantitative rate of return system index for each currency.

3.3 Filtering Factors and How to Determine their Validity

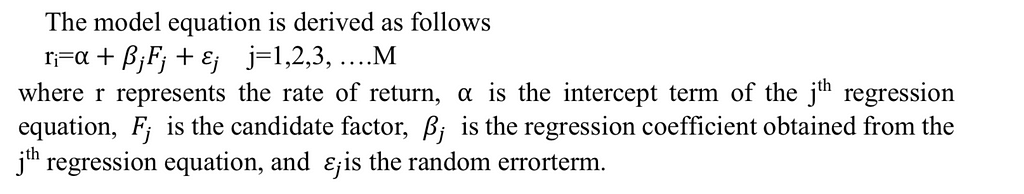

Selection of factors is the central part of the model. Since using an excessive number of factors to construct the model will impair the interpretability of the model, the model should select only crucial factors while keeping as low as possible. Regression method and ranking algorithnm are commonly used for factor selection, but in view of the late development of the cryptocurrency market and the limited amount of relevant empirical studies, regression method is thereby chosen in this context.

This method is divided into two main parts. Firstly, validity of the factors affecting asset returns is tested and verified, followed by the elimination of valid but relatively redundant factors.

3.3.1 Determining Validity of Factors

In this section, independent factors are used as explanatory variables and the predicted variable is projected to be the rate of return of cryptocurrency based on which a linear regression model is constructed. The validity of the individual factors is assessed comprehensively by obtaining the corresponding coefficients β for each factor, the Goodness of Fit of the equation, and the t-value of the hypothesis testing statistic. At this stage of model construction, the data has both individual and time characteristics, hence a Pooled Regression Model is used to form a new series of data without ndividual and time information, and then OLS (Ordinary Least Squares) regression equations are applied to estimate the parameters. In doing so, it ensures the removal of individual and time characteristics from the data panel. Moreover, the parameters obtained from the regression are not sensitive to the time of data acquisition, thus allowing more solid factors to be taken into account.

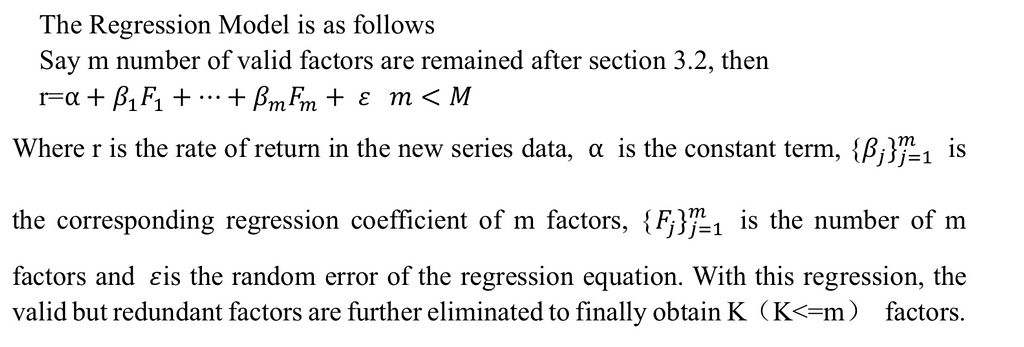

3.3.2 Eliminating Valid but Relatively Redundant Factors

Since different individual factors will be closely interrelated to a certain extent, the approach of simply selecting the effective factors is not sufficient. In this section, multiple factors are selected as explanatory variables and are jointly regressed on the rate of return of cryptocurrency. The regression coefficients obtained from the joint regression, the Goodness of Fit, the hypothesis testing statistic F and t-value are combined with the correlation coefficients between the factors. The redundant factors are then removed to obtain the finalised factors.

4. Confirmation of Factors

4.1 Determining the Impact Factor

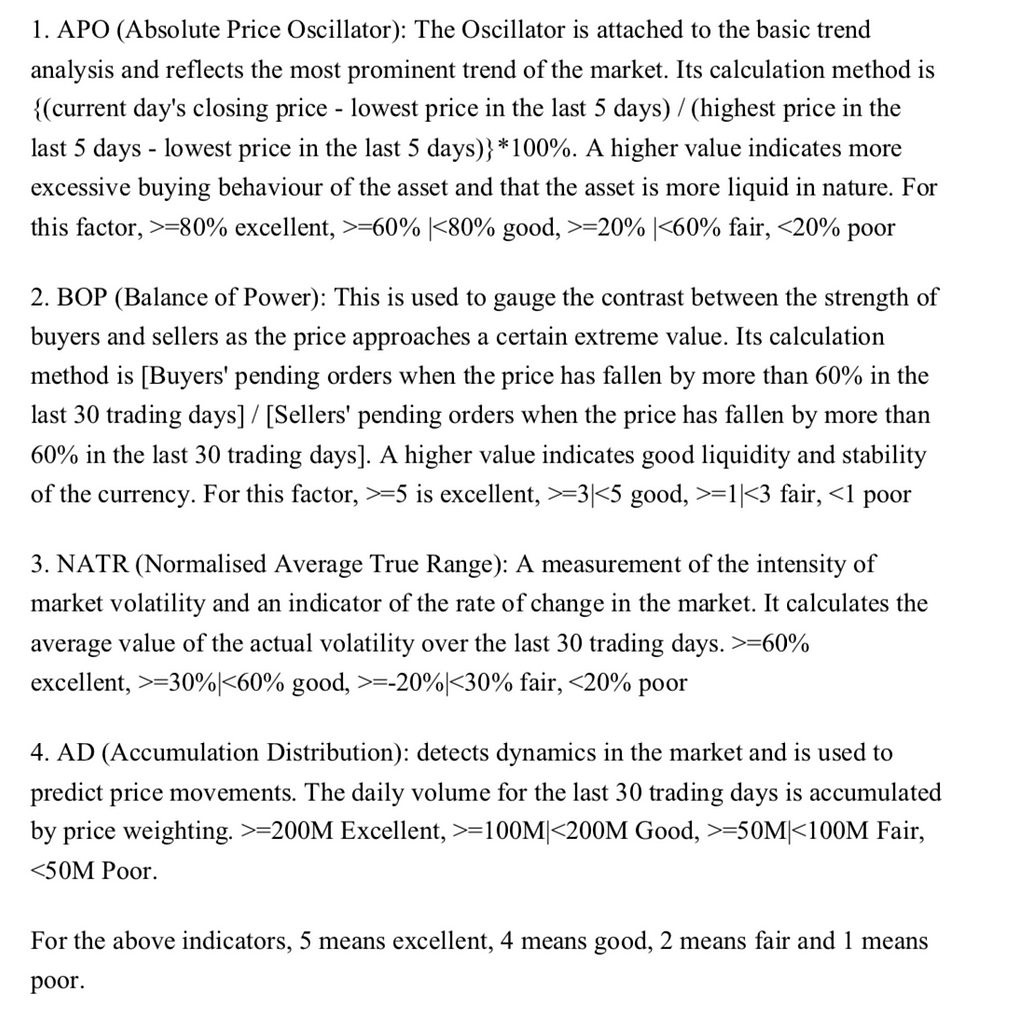

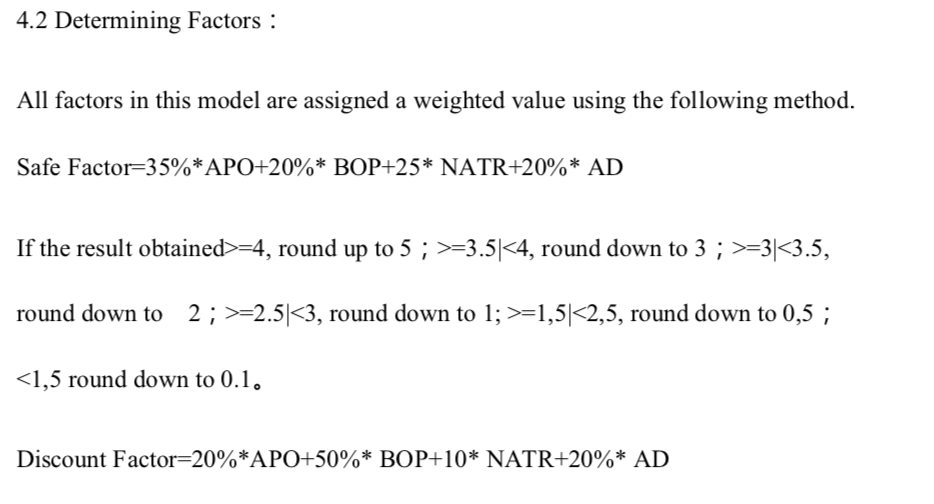

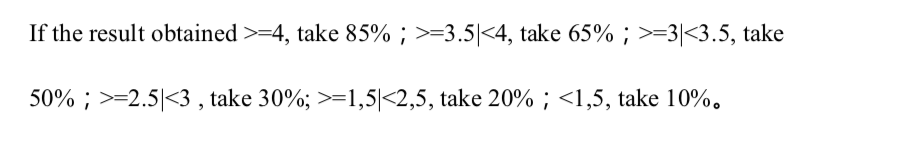

Using Dot and KSM’s lending model as examples, the following factors are projected to affect the rate of return of currencies significantly.

5. Innovations and Contributions of this model

Our team feels that this model has the potential to make significant contributions in the following aspects.

- Breakthrough from the mathematical and model-only theory in traditional Defi project modelling. Lending projects for cryptocurrencies commonly rely on mathematical models alone to describe the role of participants. However, due to factors such as its late development, inadequate historical data and inexperience of practitioners and traders, most models still lack explanatory power in the face of extreme events such as “Black Swans”. As a result, great losses are incurred for both investors and platforms.

- Pioneering interdisciplinary project between digital finance and traditional finance in the industry which leverages on the advantages of empirical testing of classical traditional finance models and the organic integration of emerging digital finance, eventually establishing a digital finance lending platform model with both theoretical foundation and strong feasibility.

- By means of empirical tests using historical data on cryptocurrencies, high feasibility and practicality of the model is ensured. Further, the theoretical basis and empirical methodology of cryptocurrencies in the current Polkadot Ecosystem are deeply entrenched and enriched.

Meanwhile, this model entails the following innovations.

- Comprehensive understanding and analysis of “Black Swan” events. Majority of traditional finance firms and previous cryptocurrency projects have used Var and ES to invert the tail correlation, which often underestimates the risk of a “Black Swan” event. However, our model is designed to take full account of tail risk evaluation by incorporating human adjustment variables into the model at the earliest stage. Our ultimate goal is to enable our risk distribution to meet the Holy Grail distribution in the future.

- The model is based on rigorous and detailed empirical analysis. With the founding team’s background experience in finance, statistics and big data science, the team has made revolutional use of a variety of big data empirical methods and statistical theories to provide empirical basis for the selection of the moderation variables in this model across different markets.

- The model is time-sensitive and has great potential to make further development. The model is constructed with innovative adjustment variables, which increases the model’s versatility to adapt to current market conditions and therefore has a strong timeliness. At the same time, as the amount of data increases, more data nodes can be added to the empirical test to bestow the model with more explanatory power, creating strong potential in its further growth.

6. Future Adaptations of the Model

The team believes that the model has an extremely high level of universality and can therefore play an important role in future subordinated loan products, option products and fixed rate lending products.

In-depth analysis of Konomi collateral and liquidation model was originally published in KONOMI Network on Medium, where people are continuing the conversation by highlighting and responding to this story.