DeFi’s recent nosedive

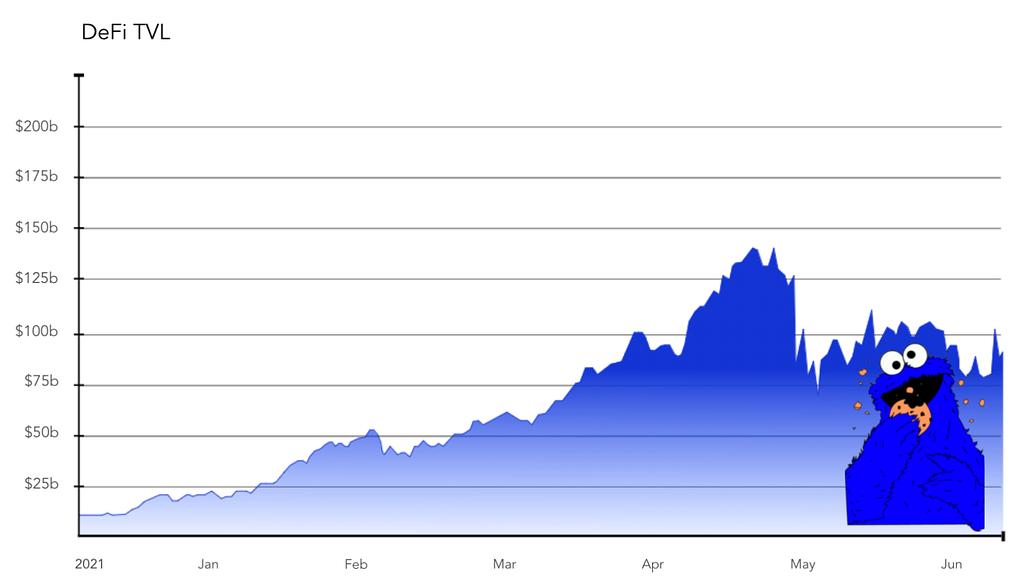

The last few months have seen a lot of attention on the decline of the crypto market: not only were ETH and BTC affected, but so were the financial products that depend on them in DeFi.

Total Value Locked (TVL) is the metric used to measure the amount of wealth locked in DeFi. But when BTC fell from half of its all-time high, this was mirrored in all the major DeFi protocols. That’s because all of DeFi is correlated to crypto.

All except Tinlake, the financing Dapp built on Centrifuge.

Why Didn’t Tinlake Crash?

Tinlake experienced its usual growth of TVL during the crash. Why? Because Tinlake finances Real-World Assets (RWA). RWAs are not correlated to crypto: they are assets outside of crypto that need to be financed. If ETH crashes, the housing market doesn’t. Therefore NewSilver’s real estate pool on Tinlake is still operating safely, with TVL growing steadily.

Centrifuge is building the most diversified marketplace of assets in the world

The diversification of assets is the crux of Centrifuge: we are building a haven in crypto for stable returns. Tinlake users can hedge the risky crypto environment, investing with Dai and other stablecoins, but still remain in the crypto sphere.

Tinlake currently hosts 10 different asset types, or pools, on the decentralized application (Dapp). Each one of these asset types can already onboard billions in assets to Centrifuge. The two biggest uses cases so far have been asset-backed securitization and invoice factoring:

According to S&P Global, $1.070T in total new asset-backed securities were issued in 2020, and this number is expected to reach $1.225T in 2021. Based on the 9.78 % CAGR between 2015 and 2021 and extrapolating the growth rate to the next 5 years, we estimate new issues in 2026 to be worth $2.046T. If Tinlake is successful, it can achieve 3 % of the global ABS market, resulting in $61.3B in new securities being financed via Tinlake every year. — RBF

Invoice factoring pools, such as Harbor Trade Credit and ConsolFreight, open up another market for Centrifuge:

We expect that if Tinlake evolves into the go-to platform for asset originators and investors, it can also achieve €72B ($86B) in annual originations from the factoring vertical. This would translate into an approximate 1.8 % market share of the global factoring market. — RBF

Quite literally trillions of dollars can be financed through Centrifuge, not including the unknown, new value created through crypto-native markets that will also eventually spin pools on Centrifuge.

Unique across all chains

As the leading project tapping into this phenomenon, we are excited to see a future for crypto that bridges the gap between traditional finance and DeFi.

Join the community and discuss all things Centrifuge through our Twitter, Discord or Telegram!

There is no bear market with diversified real-world assets was originally published in Centrifuge on Medium, where people are continuing the conversation by highlighting and responding to this story.