Dear Hydraheads,

Our mission statement here at HydraDX might as well be formulated as making Automated Market Makers (AMMs) great again. Over the past 12 months, we have been designing and developing the Omnipool with the aim to tackle the greatest shortcoming of the traditional AMM models - capital inefficiency.

To a certain extent, the capital inefficiency of traditional AMMs is caused by two factors: liquidity fragmentation and unsustainable tokenomics. The first factor - liquidity fragmentation, is an inherent design shortcoming of most AMMs which are limited to trading pairs of assets. The second factor - unsustainable tokenomics, is largely seen as a project choice, however it is also the result of the flawed design of AMMs which constrains the ways in which liquidity providers can accrue value.

We have come a long way since the LBP event in 2021 - our Research department has finished refining and validating the Omnipool, and the development of our Substrate pallet is entering its final stages. This provides an excellent opportunity to start opening Pandora’s box and make the mechanisms behind the Omnipool accessible to everybody.

In this post, we elaborate how we overcome liquidity fragmentation by bringing all trading assets in a single liquidity pool called the Omnipool. The resulting deep and concentrated liquidity paves the way for various economic efficiencies such as less slippage and lower trading fees.

This novel, unconstrained AMM design also allows us to develop the HydraDX tokenomics in a sustainable way. An overview of the mechanisms behind the HydraDX tokenomics will follow in the next Omnipool post (Part 4).

Time to drain the fish bowls.

Traditional AMMs: Fragmented Liquidity

The emergence of the first AMMs marked a pivotal moment which provided the first liquidity infrastructure for truly decentralized and permissionless finance and propelled the DeFi summer of 2020. Two years later, the future of AMMs is becoming uncertain, as users become wary of the capital inefficiencies pertaining to the traditional AMM model and one of its inherent design shortcomings: Fragmented liquidity.

Fragmented Liquidity.

The graphic above exemplifies the issue of liquidity fragmentation. In the traditional landscape, allowing users to trade DOT, HDX, KSM, ACA and GLMR would require setting up (at least) 4 separate trading pools. In most cases, these pools would have rather shallow liquidity, which is why a much better analogy for them would be fish bowls.

The first obvious issue with having shallow liquidity dispersed over many fish bowls is slippage. Placing a big order in an illiquid trading pool will make you pay a higher price for obtaining the assets, as compared to the market price. To follow the previous analogy - dropping a huge fish in a small fish bowl might cause the bowl to overflow and lose liquidity.

But there are other issues, as well. What happens if a user wants to trade HDX with KSM? In our current fragmented landscape, the order would need to be routed through 2 pools - HDX/DOT and then DOT/KSM. In the absence of another HDX / KSM fish bowl, the order cannot be executed directly.

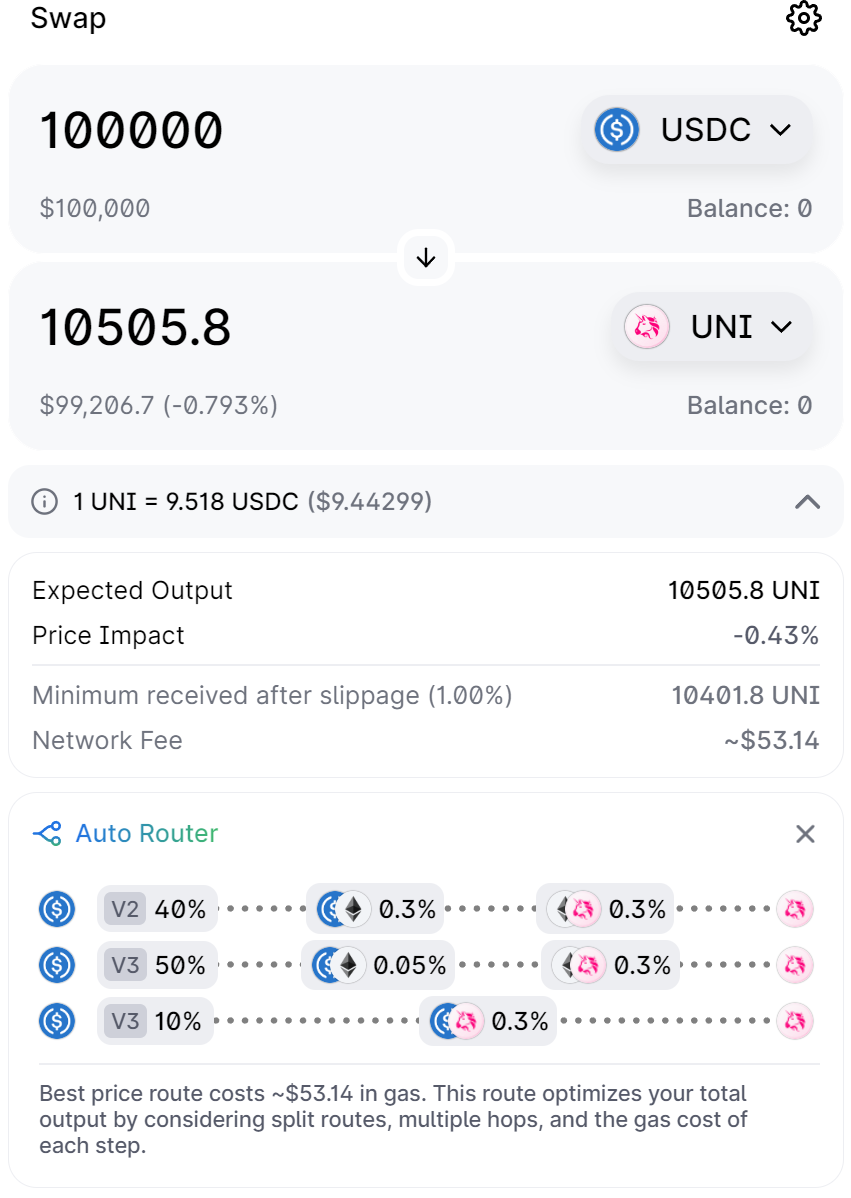

Source: Uniswap. Auto Router shows the pathway taken to complete the trade.

In the USDC / UNI example above, even for two of the most liquid assets in DeFi, it would require the routing of 3 different XYK pools (2 of which requires two-hop trades) on Uniswap in order to execute a $100k order. This is in spite of the liquidity provided by LPs for each asset which is in the tens and hundreds of millions.

Finally, the traditional AMM design in which trading pools consist of pairs of assets often comes with the exposure to Impermanent Loss (IL). For example, if a user wants to provide stable USDC liquidity for a USDC/UNI pool, they would be required to provide an equivalent amount of UNI (in ratio 50:50) which exposes them to the volatility of the other token.

HydraDX Omnipool: Concentrated Liquidity

The solution to fragmented liquidity is simple - concentrating liquidity. By placing all assets in a single trading pool called the Omnipool, liquidity becomes vast and deep resembling the ocean, instead of an artificially shaped fish bowl.

Being a simple idea by itself, building a single AMM that accommodates many assets is a complicated endeavor, which is perhaps one of the reasons why this novel yet intuitive AMM design has not established itself broadly yet.

One of the central mechanisms which make the Omnipool possible is Lerna (LRNA), our pool token through which all transactions flow. Once a liquidity provider adds or removes liquidity from the pool, a corresponding amount of LRNA tokens is respectively minted or burned. Just as shapeless and flowing as the ocean, LRNA’s supply fluctuates depending on the provided liquidity, helping keep the ecosystem in balance.

Concentrated Liquidity.

Having all liquidity concentrated in a single AMM brings a variety of efficiencies as compared to the traditional model described above. Big orders will experience negligible slippage when they are executed against deep liquidity.

Furthermore, the Omnipool allows for a seamless on-chain execution of trades between any of the assets it hosts. Trading HDX for KSM is possible in a single transaction, there is no more hopping required between isolated trading pools, thus helping to further reduce slippage and trading fees.

Another superior advantage of the Omnipool design is the way liquidity is provided. While in the traditional model liquidity providers would need to deposit an equal share of both assets to the fish bowl, our ocean of liquidity accepts single asset liquidity provisioning. This means that adding KSM to the Omnipool simply requires the liquidity provider to deposit KSM. The pool will mint the equivalent amount of LRNA automatically, thus creating a synthetic XYK subpool (i.e. KSM / LRNA) and removing the need to provide the second asset.

This feature of the Omnipool gives users greater control over their risk exposure - they are free to decide how much liquidity they would like to provide, and for which assets. The exposure to IL is now directed towards LRNA which, as a hub token, reflects the value of the whole basket of assets existing within the Omnipool. With the mechanisms we have in place for LRNA (more to share in Part 4), we expect IL to be partially mitigated over time.

Finally, having liquidity concentrated in the Omnipool has allowed us to design our tokenomics in a sustainable way which facilitates long-term value accrual to stakeholders. We will explain how we have done this in the upcoming Part 4 of the Omnipool series.

Eventually, the fish bowls will be drained and liquidity will return back to where it belongs - the ocean.

Stay hydrated.