Dear community, our liquidity bootstrap event has come to an end. We have managed to gather substantial liquidity both into the market maker pools and into the bailsman pool and we are thankful to each and every one of you, who participated in the event. Our innovation is impossible without you, our beloved community.

We are looking forward to other users joining in, as we’re reimagining together how a fully on-chain and first of its kind order book based DEX in Kusama should operate. We have some important announcements to make about Genshiro’s further plans for the campaign, so grab a coffee and follow on.

Event results

Here are some stats worth highlighting from our experience so far:

MM pools collected $643K of liquidity in total, while the bailsman pool collected $830,000 of liquidity. Interestingly enough, most of the liquidity in the bailsman pool came in the form of BUSD tokens, where more than 450,000 BUSD was supplied.

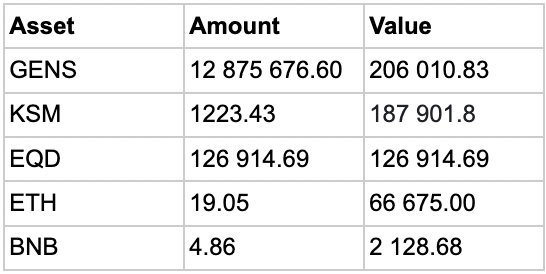

Of course, we’re interested in launching our DEX with some decent liquidity behind it, so let’s check out the breakdown of MM pool liquidity by asset:

Data suggests the system is lacking bid-side liquidity in the form of EQD tokens, and there is also not so much liquidity for the ask side in major assets like ETH or BNB.

Launch of the first trading pair: KSM / EQD

As we’ve managed to gather enough KSM and EQD to provide meaningful liquidity and order book depth for the KSM / EQD trading pair, as confirmed with the market maker, we will launch this trading instrument to be the first one available to trade on our DEX.

The launch itself still requires integration activities with the first onboarded market maker PNYX ventures, so we require some additional time to test APIs and integration to make sure the launch goes as smoothly as possible. This will take us approximately another two weeks to complete, so please be patient and follow our updates.

Liquidity bootstrap mechanics going forward

Although we’ve seen your extraordinary support, our targets of $500K on each side per asset have not yet been met, this led us to the decision to make some alterations to the bootstrap mechanics. Here are the changes we introduce:

- The bootstrap event will now last indefinitely, all the threshold rewards are kept as is and will be distributed once each of the threshold is met (see our previous article for details)

- We will launch other trading pairs in a scheduled manner when at least 500K ask side and 500K bid side liquidity thresholds are met for the particular pair.

Last but not least, we’re preparing a liquidity funding proposal for Kusama governance to boost up the activity by offering us liquidity in KSM. The aim is to attract enough KSM and EQD (generated against KSM) into the liquidity pool to launch the KSM / EQD pair with as much liquidity as possible, as well as ensuring enough quote side liquidity (in EQD) for other trading pairs.

About Equilibrium and Genshiro

Equilibrium is a cross-chain DeFi super-app that allows for cross-chain borrowing and trading digital assets with high leverage. It combines a money market with the lowest collateral requirements ever and an orderbook DEX with leverage up to 20X.

Genshiro is a Kusama-based sister-chain for Equilibrium. It’s the protocol that helps users seamlessly earn yield, borrow, and trade on margin. Using asset portfolios instead of single collateral vaults.

Equilibrium: Your unified DeFi multi-tool:

Lend, borrow, stake, swap, trade, earn — all cross-chain

Join Equilibrium on: Telegram, News Channel, Twitter, Medium, Website, GitHub

Genshiro Liquidity Bootstrap event updates was originally published in Equilibrium on Medium, where people are continuing the conversation by highlighting and responding to this story.