Crypto markets saw a crash over this past weekend that wiped out somewhere between $200-$300 billion of total crypto market cap. Maker hit $118.8 million in liquidations on Jan. 21, while Aave maxed out in terms of daily highs at $61.13 million on Jan. 22. Just about everyone in crypto was affected, and Equilibrium’s Genshiro was of course no exception here.

GENS itself fell as much as 50% while other major tokens continued to decline: BTC was down 23% since last week, Ether down 35%, Binance’s BNB down 32%, ADA down 31%, and Solana down 45% all in the same timeframe.

There is a certain “perfect storm” element to these market events because we had just released the Genshiro crowdloan and lockdrop rewards on Thursday, then there was a severe and sudden market decline shortly thereafter. Let’s talk about what happened, how the system proved its sustainability, and what we plan to improve going forward.

In simplest terms, we had allocated almost $50 million USD worth of GENS tokens to our users as rewards for supporting our project. But under Genshiro crowdloan rules, only 10% of these tokens were available immediately to users after the distribution event. In total, approximately 30 million GENS tokens actually entered circulation, which is equivalent to approximately $2 million USD at the time of this writing.

But hindsight is of course 20/20: it wasn’t a great time to release these tokens. The uncertainty around a new variant of COVID-19, as well as a downturn on the US capital markets and expectations of seeing the Fed hike rates this year led market participants to reduce their exposure to risky assets across the board.

A number of our users saw their positions liquidated, and our bailsmen ended up absorbing defaulted loans around 10% in order to effectively manage the situation and continue operations as normal.

But this is precisely the kind of event that our system was designed to sustain. While these market-triggered events are regrettable for nearly everyone in crypto, our system still managed to perform exceptionally well in spite of it all. During this event there wasn’t a single cent of debt not unbacked by underlying assets.

As mentioned, the total debt liquidated in the wake of this downturn amounted to less than 10% of our total bailsman liquidity. Our insurance pool could’ve theoretically sustained 10 times the liquidations it did while still managing risk and keeping the system solvent.

It nearly calls MakerDAO’s Black Thursday from 2020 to mind, when a market drop of similar magnitude saw more than $8 million liquidated for 0 DAI. In our case, the black swan flew and Genshiro was able to ride it out.

There were loans backed by GENS tokens in the systems. Due to the given market downturn, some of them were liquidated and bailsmen have received this collateral in GENS and liabilities in other assets to cover.

Of course, these liquidations could not have any significant impact on the system, but following our community feedback, we have temporarily disabled the use of GENS as collateral for borrowing within the system in order to curb any malicious intent. Though GENS are still accepted in bailout liquidity pools without any limitations and liquidity farming rewards are regularly accrued on them.

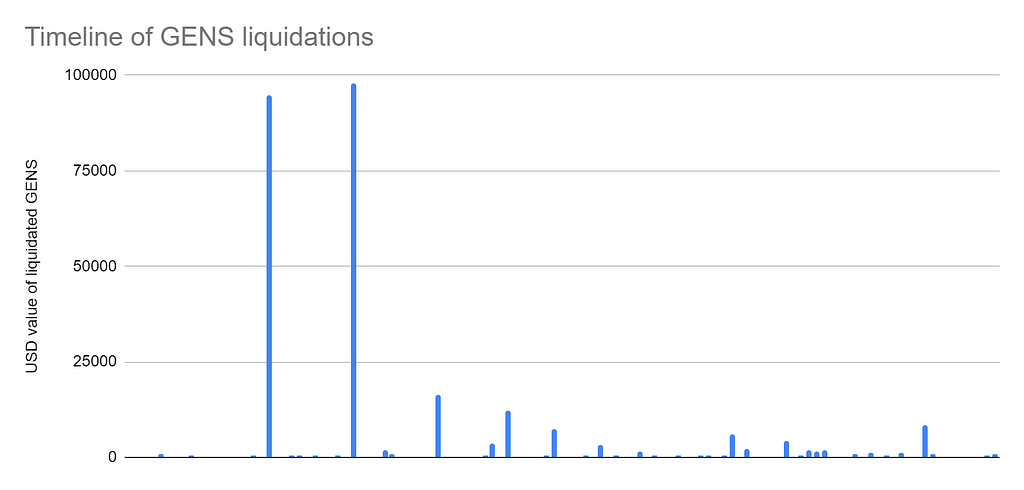

This is how GENS collateral liquidation went across the timeline looked like:

Fig 3. Liquidation values of GENS collateral from January 20, 2022 00:00 UTC to January 24, 2022: 09:00 UTC

If you are interested in learning more about recent events in the Genshiro protocol we are preparing an extended version of analytics that will include more numbers and data models for your reference. This analytics will be revealed in the coming few days so stay tuned.

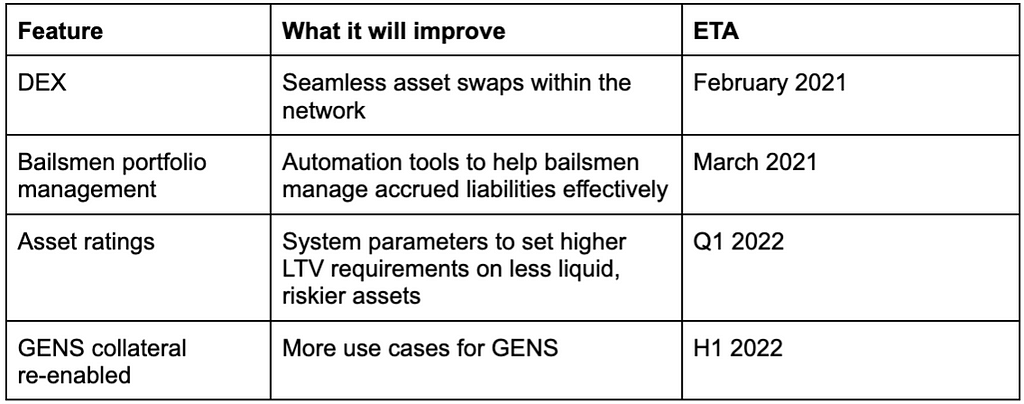

We have an extensive roadmap for how we’re moving forward from here. Here are the next important steps to enhance the bailsman user experience and allow liquidity providers to manage their risks more effectively:

Further improvements to the risk model will include debt ratings and debt tranching, where bailsmen will have a choice of desired risk-return profile, maybe even with the possibility of specifying the list of assets (collateral) they are willing to secure. Our upcoming DEX will launch soon, and it will give bailsmen a go-to tool for liquidity management. Along with the up-and-running Epsilon stablecoin pool, the DEX will significantly simplify the flow of reducing debts and managing rewards for bailsmen for most of the assets present in the system.

Besides this, there is a new farming structure to launch within the next couple of weeks — holding GENS in the system will boost your rewards by up to 100%. It will also let borrowers receive rewards on assets locked in the collateral pool. The new farming will support liquidity providers putting their assets into external liquidity pools, like the GENS/BUSD pool on PancakeSwap.

We are very thankful to our early adopters and true supporters for their kind involvement in these first steps of our all-in-one DeFi platform. Thanks to their support, our technology proved its resilience in the face of a real market crash. We are eager to reward them for being with us during these days by increasing their farming rewards by 50% for the next three months. Every user who had a bailsmen account in the system as of January 20, 2022 will be entitled to this enhanced bonus.

We want to thank our users for staying with us and riding out this market storm. We aren’t happy to see our system and users go through this experience, but we are overall pleased to see that Genshiro is gracefully sticking it through and functioning as designed. No one’s particularly comfortable in the wake of this crash, but we take satisfaction seriously in any case.

Come and join us on our 14th Community Call on January 27, 2 PM UTC. We’ll discuss our new Equilibrium’s crowdloan bonuses, increased referral bonus and talk about Genshiro’s use-cases as well.

If you have feedback or concerns to share with us, we invite you to reach out in our community Telegram channel.

Follow us to learn more:

Genshiro | Twitter | Telegram |Facebook

Genshiro Is Dealing With The Crypto Market Crash Successfully was originally published in Equilibrium on Medium, where people are continuing the conversation by highlighting and responding to this story.