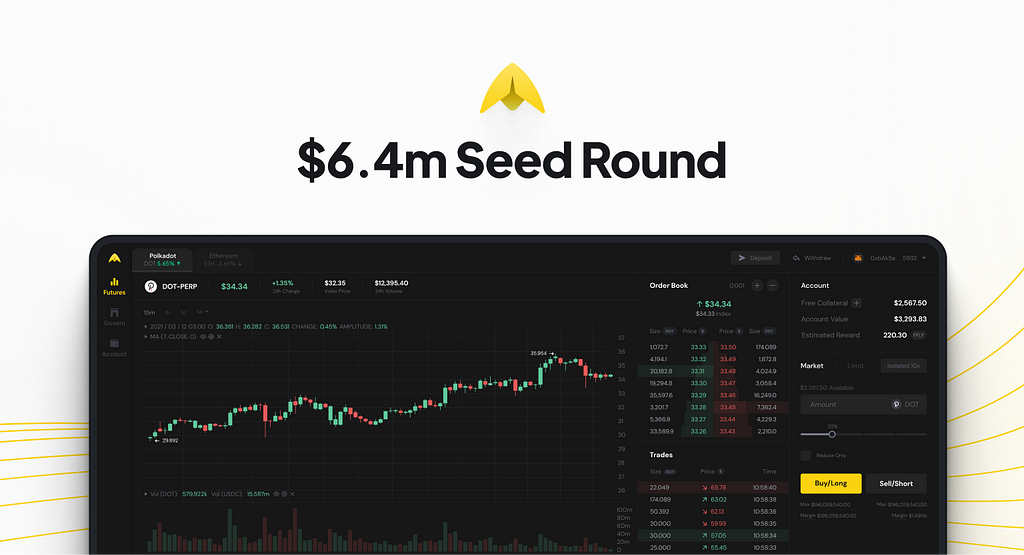

We are happy to announce that Firefly has closed a seed investment round co-led by Three Arrows Capital and DeFiance Capital, with Polychain Capital, ParaFi Capital, Huobi, Mechanism Capital, Magic Ventures, Bixin Ventures, IOSG Ventures, Hypersphere Ventures, DeFi Alliance, LongHash Ventures and Fenbushi Capital participating.

Completing the funding round is a significant milestone on Firefly’s journey to capture and lead growth in decentralized derivatives trading. Other participants in the round, including Alameda Research, CMS Holdings, Wintermute, MGNR, PNYX, Kronos, Altonomy, and LedgerPrime, will support liquidity on Firefly. Highly liquid exchanges attract traders and build network effects. Additionally, Tiantian Kullander from Amber Group will be joining as Advisor to the team. Together we will bridge performance and usability in a way that will take decentralized trading mainstream.

Firefly is the first DEX for perpetual swaps and options built on Polkadot. Firefly’s technology stack enables leveraged derivatives trading with on-chain settlement, enabling limitless derivatives markets without custodial and counterparty risks. Its performant off-chain matching engine, coupled with a constant function market maker, creates a hybrid order book plus AMM trading experience with high liquidity and pricing efficiency. Firefly aims to engineer the trading experience of centralized exchanges while providing the security and transparency of DEXs.

Derivatives are on track to become the largest market in decentralized finance, similar to how they are the largest asset class in traditional finance. Derivatives are an exciting use case of blockchain. Entirely new perpetual swaps for blockchain-based assets within Polkadot’s multi-chain architecture can be added through a simple governance proposal along with derivatives for assets from any asset class.

If you’re interested in joining us, please head over to our careers page!

About Firefly

Firefly is the first derivatives exchange on Polkadot. The fully open-sourced code underlying the protocol functions as a public utility, owned and controlled by the community of token holders. The community governance can add trading pairs for derivatives from any asset class. The Firefly DAO will fully subsidize the gas fees on the exchange for the first year. The insurance mining program is currently undergoing audits before its expected launch in June 2021, and Firefly will have ZK-Rollups integrated by the end of 2021 for instant transactions.

Firefly is governed by a Decentralized Autonomous Organization (DAO). The products available on Firefly are not available for use by US Persons or residents of any country or jurisdiction subject to US sanctions.

Check us out at https://firefly.exchange/, or on Twitter: https://twitter.com/fireflyprotocol

Firefly Closes $6.4M Seed Round was originally published in Firefly on Medium, where people are continuing the conversation by highlighting and responding to this story.