As more pools are being added on Tinlake, more diverse real world assets are entering the DeFi space. The main question when making investment decisions is whether the (expected) return of an investment is worth taking on the (expected) financial risk associated with it. Investing into Tinlake pools will give you attractive and stable yields, as well as CFG rewards as returns, but as with any other investment, using Tinlake comes with risks.

This post will dive deeper into the risks and returns associated with investing in Tinlake pools, to help you do your own research, and eventually make an informed investment decision based on your individual preferences.

Risk and return — two sides of the same coin

Before we dive into Tinlake a few more words on financial risks and returns. One general rule of thumb in finance (both TradFi and DeFi) is that risks and returns are related — higher potential returns usually equate to higher risks. Investors demand higher returns to be compensated for taking on higher risk. Keep that in mind when making any investment decision.

Additionally, investors usually have different risk preferences. Some investors feel comfortable with bearing higher risks if they expect higher returns — many active traders thrive on dealing with volatile assets. Many other investors are content with relatively stable returns knowing they are at less risk of losing part or all of their investment.

This is why Tinlake pools come with two different tranches, a junior (TIN) and a senior (DROP) tranche. DROP tokens offer a stable return protected against defaults by a TIN buffer. TIN’s returns are expected to be higher, yet more volatile as they absorb any potential defaults first. This is why TIN isn’t fully open to the public yet as the pools scale with experienced TIN investors first. You can find out more details about the TIN & DROP tokens here.

Tinlake returns and rewards

Earning yield

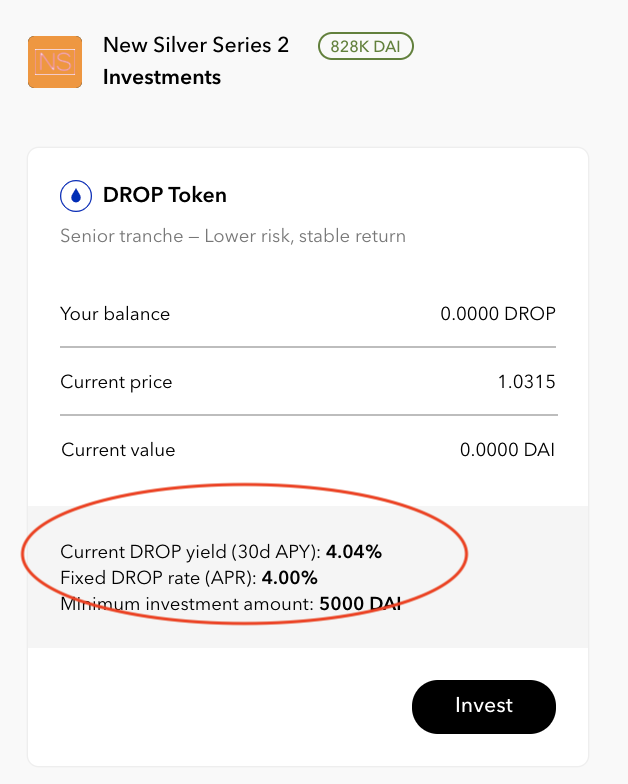

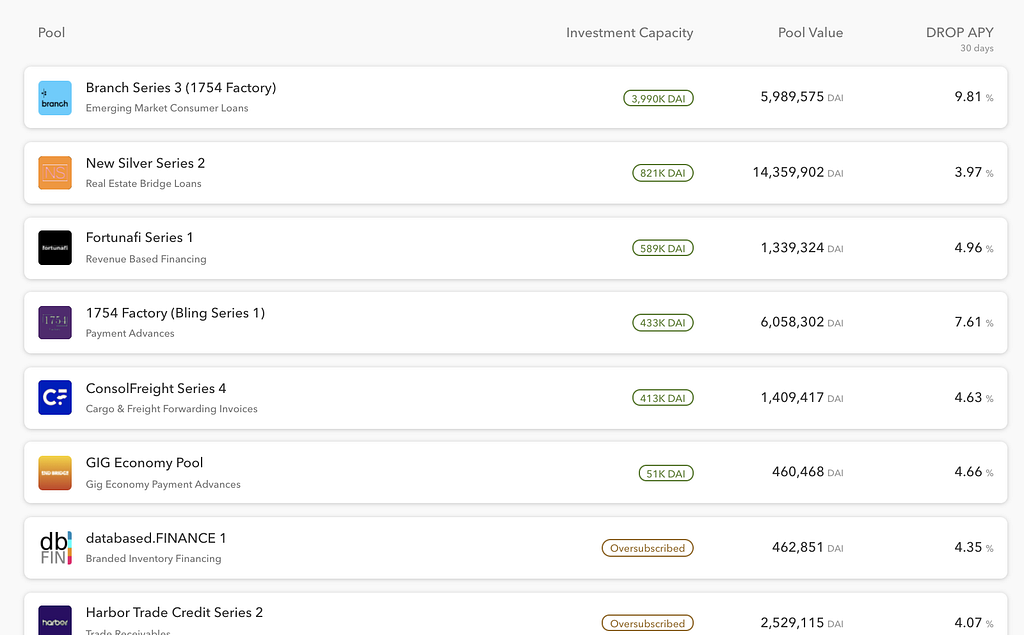

Let’s start with the returns. As a DROP investor, you will earn a stable return on your investment. Every pool has a fixed DROP rate (APR — “Annual Percentage Rate”) that earns you interest. The APR is compounded every second thus your effective yield (APY — “Annual Percentage Yield”) will usually be slightly higher due to the compounding. For example, an APR of 10% translates into an APY of ~10.50% with secondly compounding (please find more information on the differences between APR and APY here).You find both, DROP APR and APY of a pool e.g. on the pools investment page.

Note that the DROP APR is applied on financed assets only and excess liquidity in the pool’s reserve does not earn interest. Therefore keep an eye out on how Issuers manage their liquidity. A high reserve ratio decreases your effective yield. If a pool with an APY of 10.50% has a current reserve of 20% of the pool value you earn an effective yield of roughly 10.50% * (1–20%) = 8.40%. You can find the average DROP APY over the last 30 days for every pool on TInlake’s Dashboard and at the top of every pool’s overview page.

Returns for TIN investor returns will usually be higher but also more volatile. On top of earning the full interest income of the pool on their investment they also receive the spread between financing fees the Issuers pay and the DROP rate on the DROP share of the pool. In return for these higher fees, they take defaults first. For example, if an Issuer fails to repay their financing for an asset within the pool this default will first reduce the TIN portion of the pool before impacting the DROP. TIN is currently only open for professional investors with a long-term investment horizon. Interested investors can contact the pool’s issuers directly for TIN investments.

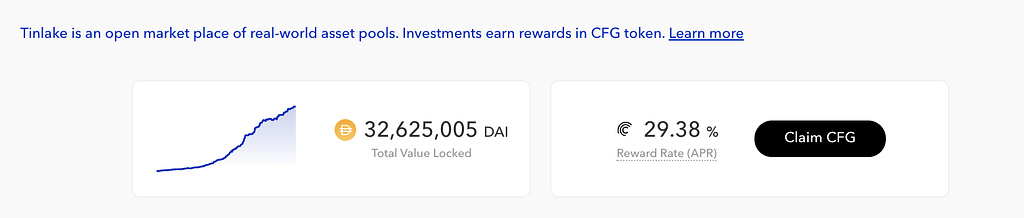

Farming rewards

On top of the interest accrued you can also farm rewards with Tinlake investments through Centrifuge’s native token CFG. CFG holders power the Centrifuge protocol by staking towards Validators to help secure Centrifuge Chain, as well as participating in on-chain governance for future chain upgrades. At the time of writing, for every day you are invested into a Tinlake pool you earn 8 CFG tokens per each 10k DAI investment. You can start claiming these rewards after a minimum holding period of 30 days (note that currently, most Tinlake pool issuers require a minimum investment amount of 5k DAI per pool). On the Dashboard the farming rewards are also displayed as an annualized reward rate based on the current CFG token price. Note that these are rewards from the Centrifuge protocol for providing liquidity to the ecosystem independent from the pool, it’s issuers, their asset originators, or any Centrifuge entity.

Risks associated with Tinlake investments

Credit/Default risk

Credit or default risk is the most common risk associated with an investment. It is defined as the possibility of a loss resulting from a borrower’s (or in Tinlake’s case an Issuer’s) failure to repay a loan. In Tinlake’s case, this may happen if an outstanding financing is not repaid by an Issuer because an underlying asset, e.g. an invoice, was not repaid.

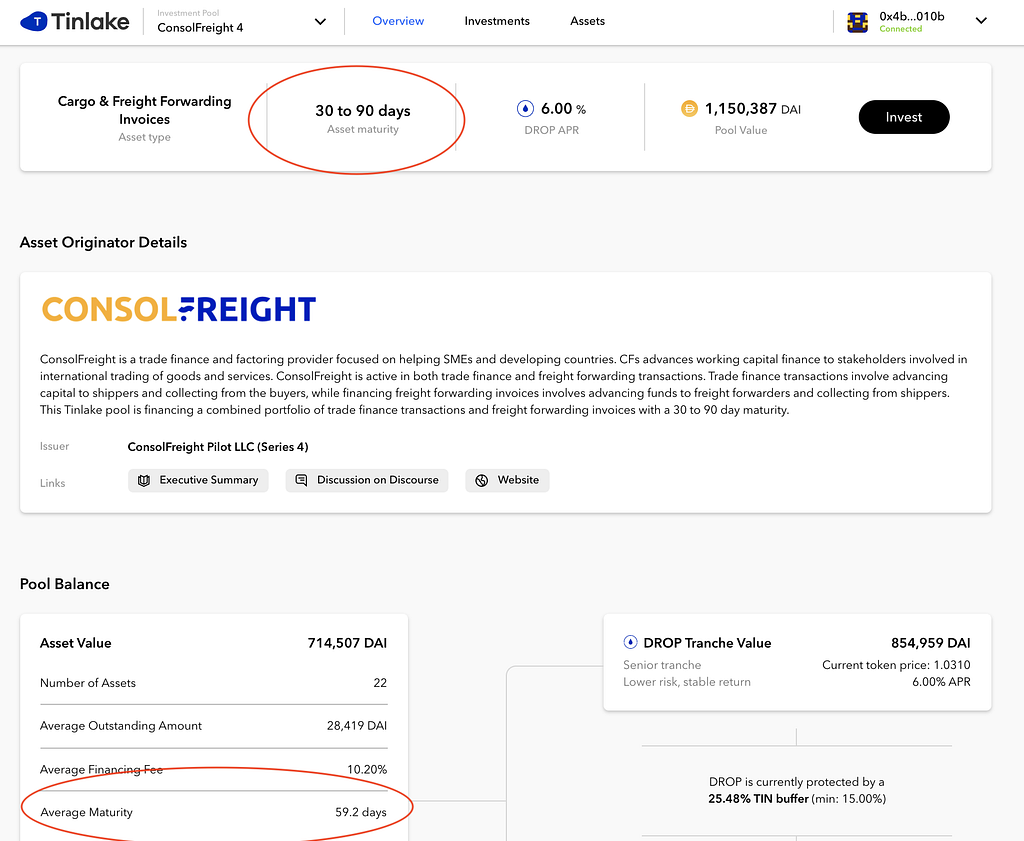

As a DROP investor you have several layers of protection against defaults. First, many Issuers only finance up to a certain percentage of the value of the underlying assets to protect themselves against default. ConsolFreight (CF4) for example only advances 50–90% of the invoice amount depending on the counterparty. The second layer of protection for DROP investors is the minimum TIN risk buffer. This buffer is a predetermined TIN percentage of the pool, which further insulates DROP investors through the first loss mechanism described above. Issuers also need to invest into TIN themselves to grow the pool and thus have “skin in the game”. If there is a default in a pool, the outstanding financing will be written off and the Issuer will take any first losses themselves, incentivizing them to undertake quality underwriting. Lastly, in case of a default, often a large part or the entire outstanding amount can be recovered through liquidating the collateral, e.g. in the case of New Silver, the underlying real estate. Note that until now, there haven’t been any defaults in any Tinlake pools.

Liquidity risk

Liquidity is how easily an investment can be converted to cash. In Tinlake this refers to how quickly you can redeem your investment if you want or need to. This depends on how much liquidity currently is in the reserve. If enough liquidity is in the reserve and you lock your DROP/TIN token for redemption they should be executed at the next epoch (usually daily). Repayments from Issuers and investments from other investors also increase the reserve to serve redemptions. This means, the maturity of the underlying assets can be seen as a “soft lock”. In case no one else wants to invest, this is the longest period your investment may be locked before you can redeem.

You can find the expected range of maturities and the current average maturity for every pool on the “Pool Overview” page.

Interest rate risk

Interest rate risk denotes the risk that changes in the underlying interest rates impact your investment. In the case of Tinlake, this mainly relates to changes in the financing fees (which impact TIN returns) and DROP rate. The financing fees and DROP rate are fixed but they can be changed with a notice period of several weeks by the Issuer. In this case the Issuer amends the pool’s legal documents and informs the pool investors of a pending change to the DROP rate. This gives investors the time to redeem if they do not want to remain invested at the new conditions. Note that this rarely happens and usually in line with market conditions.

Exchange rate risk

Exchange-rate risk arises from the change in price of one currency in relation to another. This is not inherent to Tinlake but is still a risk you should be aware of in DeFi as well. Tinlake pools are (so far) predominantly denominated in DAI, which is pegged to the USD ~1:1. If the peg breaks the value of your investment in USD terms may change. If you are an investor usually holding funds in a different currency than USD, e.g. EUR or GBP, you take on additional exchange risk between DAI & USD and these currencies.

Smart Contract risk

Among many innovations and the potential to build a new, open, decentralized financial system DeFi has also introduced a new kind of risk to the financial world: Smart contract risk. Smart contracts may contain bugs that may lead to loss of funds or may be exploited. To minimize this risk, Tinlake’s smart contracts have been audited twice now and are undergoing a third audit at the time of writing. Please find the audit reports here.

To sum up

This blogpost provides an overview of both the rewards and risks attached to investing in Tinlake pools. As with every financial investment it is really important to DYOR before investing, however we believe that Tinlake offers DeFi investors unique risk/return profiles uncorrelated to volatile DeFi returns.

Risk and rewards of investing into Tinlake pools was originally published in Centrifuge on Medium, where people are continuing the conversation by highlighting and responding to this story.